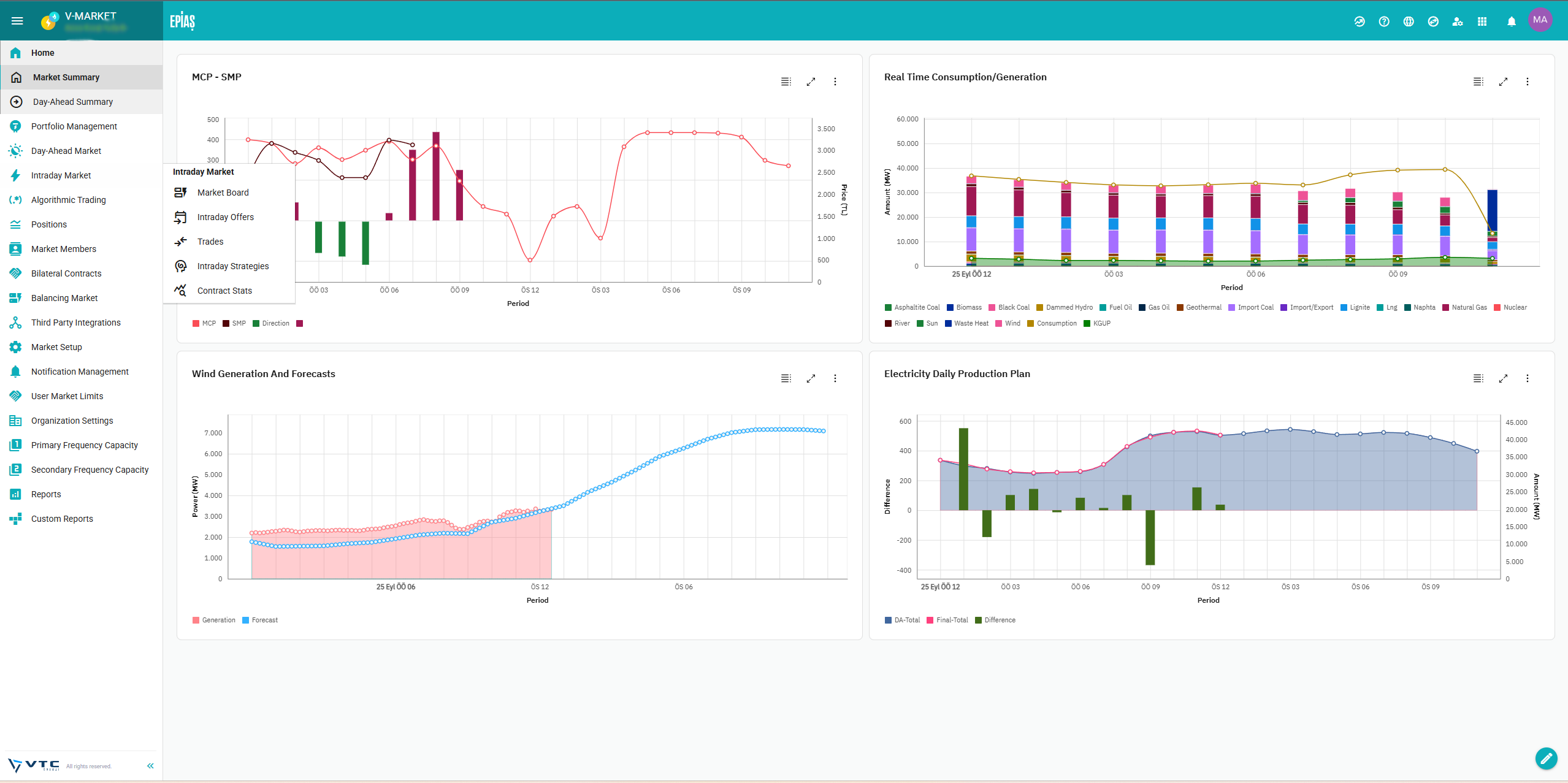

V-Market,

is an advanced software platform that automates and optimizes energy trading processes by enabling digital integration between companies operating in energy markets and market operators. It allows you to easily manage day-ahead, intraday, ancillary services markets, and over-the-counter bilateral agreements from a single hub.

Automation

Automate bidding, position closing, and opportunity tracking with market data-sensitive algorithms. Gain speed with ready-made bots and ensure flexibility by defining your own rules.

Market Integration

Access to day-ahead, intraday, ancillary services, and OTC markets from a single platform. Manage bidding, matching, and reporting processes centrally thanks to full integration with energy exchanges systems.

Portfolio Management

Track your DAM and IDM transactions in detail thanks to the structure separated by power plant, meter, or trader. Set separate targets for each unit, monitor their progress, and let the system take action on your behalf.

“Thanks to V-Market, we have almost completely automated our bidding processes. Instead of manually tracking the market, we now define our strategies and watch the system work for us. We felt the biggest difference in position tracking.”

1. What is the V-Market?

V-Market is a cloud-based software product that enables companies operating in energy exchanges to manage their energy trading processes using algorithmic trading capabilities. V-Market is designed for energy trading specialists working in the energy trading departments of electricity producers, suppliers, energy trading companies, and companies holding aggregation licenses.

2. Which energy markets can I trade in with V-Market?

V-Market is integrated with other European energy exchanges that operate on similar infrastructures, such as EPEX Spot, Nord Pool, EXIST, HUPX, IBEX, OPCOM, CROPEX, BRM, and others. Trading is possible in day-ahead, intraday, and bilateral agreement markets.

3. What security protocols does V-Market implement? How is IT security ensured?

V-Market has industry-standard encryption, authorization, and auditing capabilities and uses a cloud infrastructure compliant with ISO 27001. All data transfers are conducted over encrypted channels.

4. Can I trade algorithmically with V-Market?

Yes. V-Market allows you to trade automatically with ready-made algorithms or develop your own strategies.

5. Can I integrate my own trading strategies?

Yes. You can develop your own energy trading strategies however you like.

6. Is algorithmic energy trading regulated?

Yes. V-Market fully complies with the rules of every exchange you participate in. All transactions are logged and reported with timestamps.

7. Can I manage flexible assets such as batteries, flexible consumption or renewable generation with V-Market?

Yes. V-Market is designed to optimize and automate market participation of flexible portfolios such as batteries, consumer assets, and solar/RES.

8. Can I only pull market data with V-Market?

Yes. If you prefer, you can only pull market prices, demand forecast data, and historical transaction reports. This data is provided through an API or user interface.

9. Does V-Market integrate with existing ETRM or ERP software?

Yes, V-Market offers all its functions as a Rest API. V-Market can be integrated with ETRM, ERP, SCADA, and CRM systems.

10. How long does it take to start using V-Market?

The installation and onboarding process typically takes a few days. This time may vary depending on your integration needs.

11. Is there a free trial of V-Market?

Yes. We offer a limited-time demo environment for companies who want to get to know our product and experience algorithmic trading.

12. What are the reporting features in V-Market?

Instant position, portfolio profitability, imbalance, risk and market analysis reports are automatically generated and can be exported in PDF/Excel/Power BI format.

13. On which devices can V-Market be used?

The platform is both web-based and optimized for access on tablets and mobile devices. You can also use the V-Gen Mobile app, available on the App Store and Play Store, to perform algorithmic intraday trading with V-Market.

14. Can I share data with V-Market via API?

Yes. You can automatically transfer price and transaction data obtained from the market to your own systems via API.

15. How is V-Market different from other energy trading software?

V-Market distinguishes itself from its competitors with its multi-exchange integration, user-friendly interface, algorithmic trading infrastructure, and flexible integration capabilities. It not only allows you to trade energy from a single screen, but also integrates with products like V-Sensor, V-Plant Manager, V-Forecast, and V-Report, enabling everything from power plant management and demand forecasting to real-time monitoring and detailed energy market reports.